** Did you know that if you sell your house after 2012 you will pay a 3.8% sales tax on it? That’s $3,800 on a $100,000 home etc.

When did this happen? It’s in the health care bill. Just thought you should know. **

Took you that long to read it? There is more to come.

You must have received this in an email. :roll:

This is inaccurate. The truth about the bill is that if you sell your home for a profit above the capital gains threshold of **$250,000 per individual or $500,000 per couple then you would be required to pay the additional 3.8 percent tax **on any gain realized over this threshold.

It doesn’t matter, it is still taxation without representation, so carry on sheeple.

Do you even no what that means?

That’s nothing, by the time you pay for all your free medical you might as well give the the whole house and plead for a reasonable rent

A 3.8 Percent “Sales Tax” on Your Home?

April 22, 2010

Q: Does the new health care law impose a 3.8 percent tax on profits from selling your home?

A: No, with very few exceptions. The first $250,000 in profit from the sale of a personal residence won’t be taxed, or the first $500,000 in the case of a married couple. The tax falls on relatively few — those with high incomes from other sources.

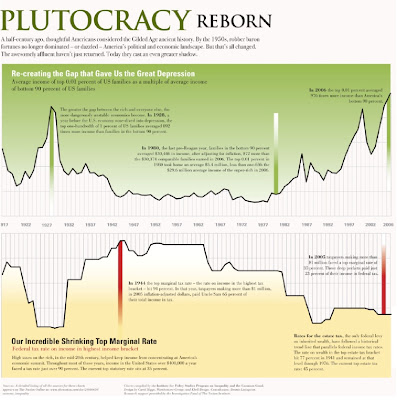

If you keep taxing high income earners, you prevent them from becoming wealthy. That is why Bill Gates and Warren Buffet are in favor of raising taxes on high income earners. It prevents everyone else from becoming wealthy and makes their working capital more rare and thus more valuable.